Over the half term week the sun was shining and people headed to the beach, but not the beaches of Spain, France or the Canaries. So who is pushing to get on a plane and who is staying at home, when travel restrictions lift and Italy and Spain beckon? What strategies should airlines follow to get the balance right between keeping planes flying and maintaining the confidence of passengers and employees?

The challenges to the industry are many including:

- Social distancing – many people have said that social distancing, as currently defined by the UK government, on planes is impossible. Aer Lingus was in the news when one of its flights was highlighted on Twitter as flying at 90% capacity with no social distancing taking place. Clearly some people are not bothered by this while others will hear about it and not trust airlines to look after their safety. The key here is setting crystal clear expectations as there does not appear to be a regulatory requirement for social distancing on planes specifically.

- But what are the rules? – Right now the Foreign Office advises against all but essential international travel but this is under constant review. The UK’s introduction of a 2 week quarantine today imposed on anyone entering the UK by air is seen by many as a death knell for airlines but given this can be self-imposed at home and many are currently working from home in isolation anyway, this may not present such a huge barrier to some UK residents. Self-isolation on holiday, however, is likely to be more of a challenge. France has reciprocated the UK’s 2 week quarantine rule but Spain and Italy have not so there are at least some destination options for travellers, although this is constantly developing with ongoing discussions with Spain.

- Who is open to flying? – Only 20% of Britons are comfortable taking a holiday abroad [1] while 45% are comfortable to holiday in the UK, according to Ipsos MORI. This compares to 48%[2] in 2019 holidaying abroad or in the UK and 16% exclusively holidaying abroad. Younger people are more likely (28% of 18-34 year olds) to be comfortable with holidaying abroad but this is probably too blunt an instrument to predict and target potential travellers. Some attitudinal segmentations are beginning to appear that highlight groups most open to getting away from the lock down by air. Kokoro’s CoronaWatch segments seem to point to a group called Pleasure seekers (41% of sample) who are more open to flying again soon.

- Who can afford it? Economic confidence is at the lowest point since the 2008 financial crash with many people worried about their jobs after the furlough schemes reduce and then finish in October.

So what tactics are airlines following and are there lessons for other industries here?

- Low cost airlines are bullish about getting back to normal with Wizz[3] and Ryanair both saying they will be ramping up services over the summer to reach 70% or 80% by July/August and September respectively. They will use low fares to tempt people back and are mentioning new rules such as not queuing for toilets or not selling food on board the plane. Wizz has mentioned that it is young people who are mainly taking the opportunity to escape.

- Expectations need to be set and met – airlines need to be mindful of their brand values and need to be very clear about their communications to customers. The key here is setting the right expectations and then of course meeting these. United Airlines was recently in the news after it emailed customers telling them middle seats would be left empty but later had to admit that this could not be guaranteed if demand for the flight is high!

- Key messages that are being used by some in the industry

- Boeing commented that Hepa air filters on today’s airplanes mean the air is virus free and similar to an operating theatre. This feels like a tricky claim to be promoting as evidence from the SARS outbreak[4] points to passengers beyond the two rows in front and behind the infected individual on the plane, having been infected.

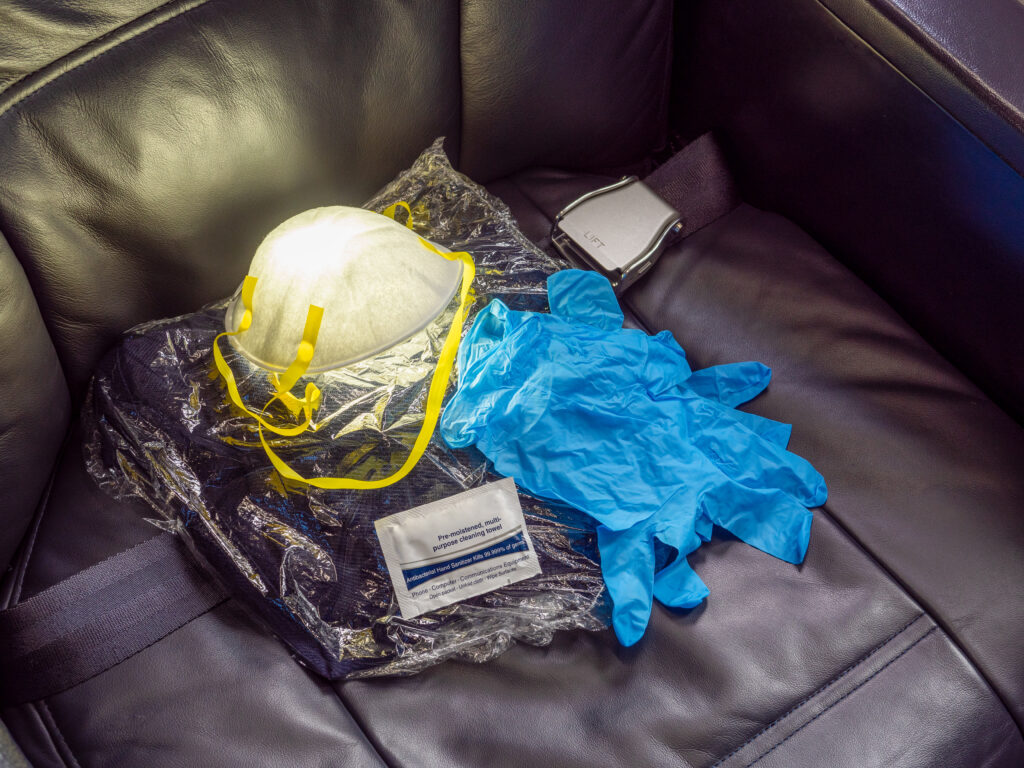

- Face coverings or masks are a difficult area for the UK at the moment as supplies of masks have been difficult even for hospitals to get. Airlines could provide masks if they can source them but could they be accused of depriving the NHS? Meanwhile face coverings will be required to be worn on public transport in England from 15 June.

- Hand sanitiser should clearly be available as there will be lots of surfaces that people will touch, moving around the planes.

- Deep cleaning planes between flights seems a good idea and while airlines are running well below capacity this could be achievable. If things get closer to normal then the turnaround times on scheduled flights could make this challenging.

- Social distancing on planes is almost impossible to achieve if 2m is the requirement but leaving the middle seat empty is a compromise that some passengers will find attractive. Budget airline Frontier were charging $39 to sit next to an empty seat but this was dropped after they were accused of ‘profiteering’. The economics of this are estimated as follows by IATA[5] – it would imply a 62% load factor, well below the 72% breakeven level and imply an estimated price increase of 54%.

- Social distancing at airports is also an issue where it has been estimated that the queue for a 189 seat plane would be 380m long at a single security line, if 2m distancing is maintained. The airport and boarding journey is effectively a succession of queues and waiting experiences. Airports and airlines need to be very clear about how this can be realistically managed if the numbers of passengers travelling is to grow again.

The airline industry has a duty to clearly communicate the measures it will take to protect passengers in order to gain the trust of more than a risk tolerant minority. People are likely to accept some kind of premium for a greater sense of security but there will be limits. Across a whole range of service industries balancing acts between acceptable risk levels and viable economics need to be struck with this taking form in a series of systematic modifications to the end to end customer journey. These changes need to be carefully designed and communicated to win back customer confidence. Ultimately people will adjust to this new reality as humanity has always done. Failing to rise to this challenge will have far reaching consequences for the travel industry and the way that it is currently structured.

[1] Ipsos MORI https://www.ipsos.com/ipsos-mori/en-uk/how-comfortable-are-britons-returning-normal-after-coronavirus-lockdown

[2] Statistica https://www.statista.com/statistics/480160/share-of-britons-going-on-holiday-abroad/

[3] FT https://www.ft.com/content/66459115-7421-4ab5-af37-4e472913553a

[4] Science Daily https://www.sciencedaily.com/releases/2020/03/200330152126.htm

[5] FT https://www.ft.com/content/abc6355a-3801-4e32-a992-f55e475d4454